In the beginning of the simulation when everything was Ceteris Paribus, there was some chaos trying to establish price. Definitely the businesses had to learn to price their thingamajigs to what people could pay. There is a reason why there isn't a Porsche dealership in Lincoln. Once the market was set - the demand for Thingamajigs was set. We had a graph looking like this.

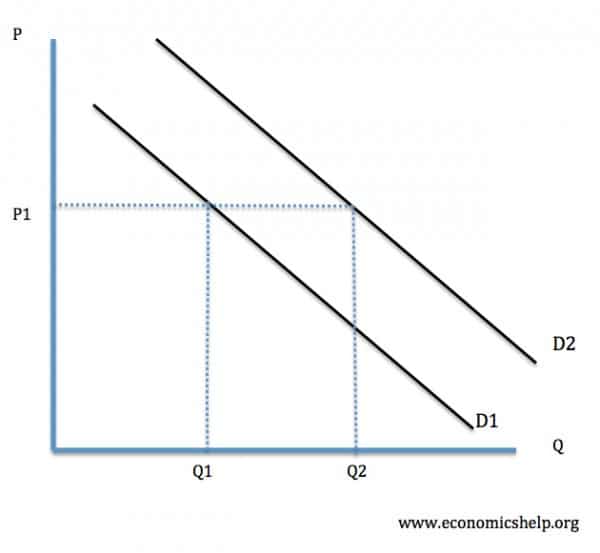

Then we had a disaster - say a hurricane and Thingamajigs were mandatory for survival. Our market really popped. Thingamajigs were more in demand and businesses quickly sold out. Consumer expectations for survival made people bargain - but less. I heard some business say "Can you put a price on your life?" That caused our curve to do the following. There was a bit less bartering. But some people struggled to buy. But the chance for higher profit made more quantity become available.

But government did step in and moved the curve back to before the disaster. BUT that did take away the stress of trying to find Thingamajigs and more people got them .... until they ran out. The businesses had no incentive to go replenish.

So, which is better? Is there a happy medium?

Congratulations to the buyers Joy, Tyson and Zen. They did the best at bargaining. On the business side, Jerick and Zach were the masters of the game and profit. Next week, I will bring prizes to class.