First things first: Someone left this coat in 205. I took the jacket to the Office.

So, what was the purpose of what we were doing today? We were learning how markets worked and establish prices. Who were the

sellers? The yellow-card emigrants were selling their labor potential. You had 4 classes of workers from highly skilled to no skill convicts. NEVER ASSUME that we all start equal at some starting line when we go out looking for jobs and opportunities. Choices and consequences, along with your abilities to market yourselves make a difference in if you achieve or not.

The goal was to sell your labor to the businesses - in this case, ship captains and agents for plantations in the south and West Indies (Caribbean) sugar cane fields. These were the

buyers. And like I said in the title - from what I overheard as well as what I noticed in the paperwork I received - you four would've given the Robber Barons of old a run for their money. Good job to Adi, Lydia, Emma and Jackson! They did not have any conscience about taking advantage of the emigrants inexperience and ignorance.

Now, we didn't get to play all the rounds I would've liked to - but I want you to take a look at another class and what was happening on their multiple rounds.

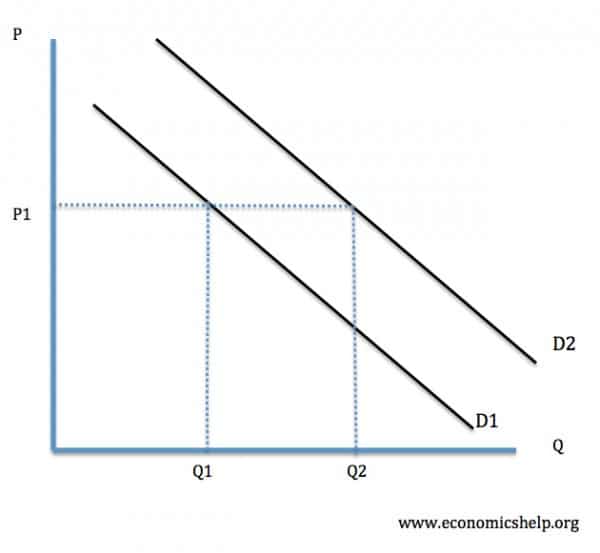

The more rounds, they were converging on a price point of around four years - very close to the historical equilibrium in the indenture markets of the 1700s of 4 years and 8 months. As people played the game more - they came to appreciate their abilities and market themselves better. They knew their "value" or as we say in Economics -

utility. While at first - no one knew their utility and we had contracts all over the place time wise. But as both sellers and buyers became more savvy, we would've reached a number very close to what other classes reach.

I urged the emigrants to ask more questions and become better informed about where they were going and what they would be doing. Quite a few of you ended up with Abi going to Jamaica. Living in the Caribbean in the 1700s was not good. 70% death rate within 36 months for indentured people on the sugar cane plantations. What killed them? 1) Malaria; 2) infections - bug bites, snake bites, cuts in the constant heat and no antibiotics created bacterial infections that made sepsis look like a common cold. 3) Dehydration in the heat and a lack of clean potable water and 4) Sugar cane manufacturing was INCREDIBLY dangerous with fires, explosions and see the above. Adi never mentioned that, did she?

Historically, that four years mark "broke" the indenture market, since it became more costly to have an indentured servant than what you would get out of them in work. When costs exceed benefits - we cease an action. And unfortunately, this is why slavery became an economic choice in particularly the southern United States. Remember that a choice might be economically right - but morally wrong, wrong, wrong.

Consider items you currently buy. Have you ever noticed that when a new market opens - prices are all over the place - consider cell phones and wearable fitness items. Over time, consumers and businesses find the "ideal price" and it always needs to be a price the consumer is comfortable spending money on and businesses can make profit.

It was a fun day - I definitely felt the psychic income. I hope you did as well.

Now, who "won": DRUMROLL: The winners are for the emigrants Shelby Parrott and Hattie Buell tying. For the ship captains / agents it was Adi Holmes - but all the captains did a great job. So, Lydia, Emma and Jackson - you can come to room 200 tomorrow and collect your donut. Which Lydia and Jackson did not do!!!